Taxes in Spain and Europe: A Necessary Comparison

Taxes are the foundation that sustains the functioning of modern states. They finance essential public services such as healthcare, education and infrastructure. However, not all countries apply the same tax burden or distribute taxes in the same way. In Europe, tax systems share common principles, although there are notable differences in the rates applied and in how revenue is collected.

Main European Taxes

Despite national particularities, almost all European Union countries share a set of key taxes:

- Personal Income Tax (IRPF): levied on individual income according to progressive criteria.

- Consumption Taxes (VAT and excise duties): applied to purchases and specific goods such as alcohol, tobacco, or fuels.

- Property Tax (IBI): paid for the ownership of homes or land.

- Customs duties, environmental taxes and inheritance or capital gains taxes complement state revenues.

Among these, VAT and personal income tax (IRPF) have the greatest impact on the economy and citizens’ finances. Let us examine Spain’s position compared with the rest of Europe.

VAT in Spain and Europe

The Value Added Tax (VAT) is an indirect tax levied on consumption. In Spain, the standard rate is 21%, while certain essential goods and services benefit from reduced (10%) or super-reduced (4%) rates, such as basic food products, medicines or books.

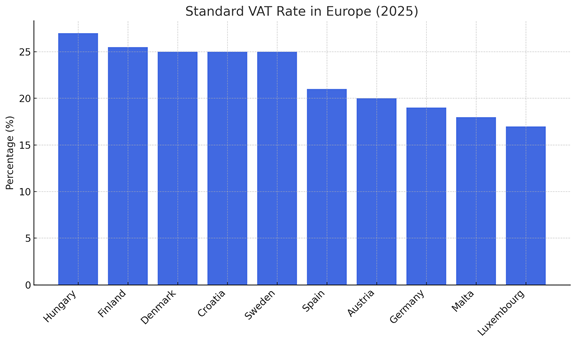

Compared to the rest of Europe, Spain is in a middle position. Countries such as Hungary (27%), Finland (25.5%), Denmark, Sweden or Croatia (25%) apply higher rates, while Luxembourg (17%), Malta (18%) and Germany (19%) maintain a lower tax burden on consumption. On average, the European VAT rate stands at around 22%, placing Spain slightly below the continental average.

Personal Income Tax in Spain vs. Europe

Personal Income Tax (IRPF) is a direct tax levied on personal income based on income level and family circumstances. It follows the principles of progressivity (those who earn more, pay more) and economic capacity.

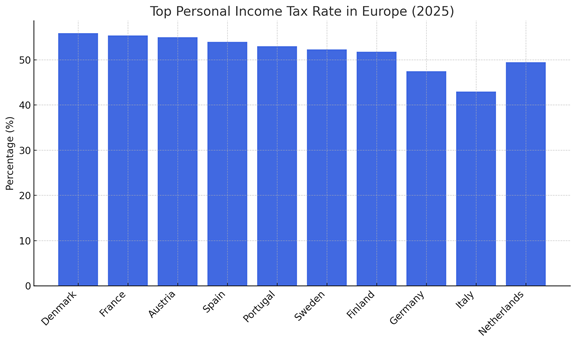

In Spain, the top marginal rate reaches approximately 54% when combining state and regional tranches, applicable to very high incomes. This places Spain among the European countries with one of the highest tax burden on personal income.

In comparison, the countries with the highest top rates are Denmark (55.9%), France (55.4%) and Austria (55%), others such as Portugal (53%), Sweden (52.3%) and Finland (51.8%) remain at similar levels, and Italy (43%) and Germany (47.5%) impose a lighter tax burden.

Comparison of VAT and Personal Income Tax in Spain and Europe

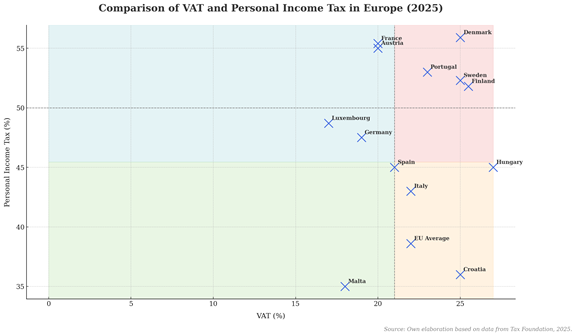

As we have seen, Spain shares the common European framework but maintains an intermediate position: a competitive VAT, a high personal income tax at the upper brackets and a constant challenge to improve the efficiency of its tax system without losing fairness.

How VAT and Personal Income Tax Affect Citizens, Companies and Countries

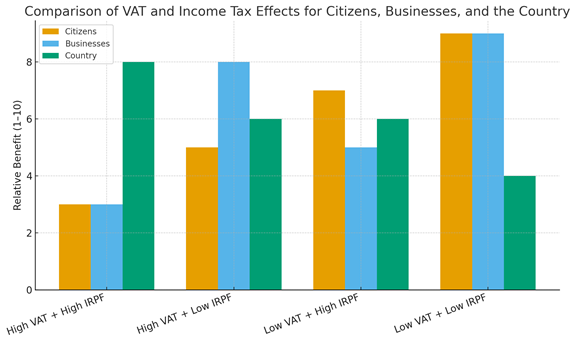

The impact of VAT and personal income tax on an economy depends on the balance between revenue collection and growth.

A high VAT increases government revenues but reduces purchasing power and consumption, disproportionately affecting lower-income households; conversely, a low VAT stimulates domestic demand but may lead to deficits.

Meanwhile, a high personal income tax supports redistribution and public financing but may discourage investment and talent, while a low income tax boosts consumption and competitiveness at the expense of a lower revenue base.

Ultimately, a balanced tax system must generate revenue without hindering economic growth and be capable of financing social welfare without compromising development, combining a moderate VAT and a progressive income tax within a coherent and sustainable fiscal policy.

Conclusions: Balancing Revenue and Competitiveness

Spain has moved from moderate tax pressure to ranking among the European countries with the highest personal income tax rates, while maintaining a VAT level slightly below the continental average. The real challenge lies not in raising or lowering rates, but in achieving an efficient, fair and sustainable tax system that collects revenue without slowing down the economy. In an European context of fiscal convergence, each country continues to reflect its own economic and social model through the balance between revenue, investment and equity.

Further information

This article is part of our service Taxes in Spain for foreigners. Visit this section where you will find all the useful information on this topic, including a complete guide Taxes in Spain for non-residents and foreigners.

Solve your doubts

✅ Our staff speaks perfectly Spanish, Valencian, English and German with what will be able to communicate with us in your own language and thus clearly resolve your queries.

📍 Denia – Plaza del Convento, 6 – Mezzanine floor door B

📍 Valencia – Calle Creu Roja, 1 – Block 6, Floor 1, door 10 (* only by appointment)

✉📞 Contact: info@firmalex.com – Tel. +34 966 421 416 – Whatsapp +34 622 497 615