The new Royal Decree-Law approved modifies the contribution system in the Special Social Security Regime for Self-Employed or Self-Employed Workers, which will be based on the self-employed person’s annual income instead of the simple choice of contribution bases.

The Official State Gazette has published Royal Decree-Law 13/2022, of July 26, which establishes a new contribution system for self-employed workers.

Among other provisions, the main novelty of the Royal Decree-Law is that the contribution to the Special Social Security Scheme for Self-Employed or Self-Employed Workers will be made on the basis of the annual income obtained in the year in which the activity was carried out.

The General State Budget Law will establish each year a general table and a reduced table of contribution bases. Both tables will be divided into consecutive net income brackets.

To facilitate this change to our self-employed clients, we have developed this guide with the steps to follow from January 2023 to adapt to this new way of contributing for their income.

1.- Calculating the net income

2.- The exception for the self-employed who have always paid more contributions

3.- What is the ImportaSS portal?

4.- Communicating the actual income forecast

5.- ImportaSS will let you know what your contribution is and when you will be charged

6.- Possibility of changing the bracket every two months

7.- Compulsory submission of the Income Tax Return

8.- Regularization of the information presented by the self-employed person

9.- Resolution of the regularization

1.- Calculation of the net income

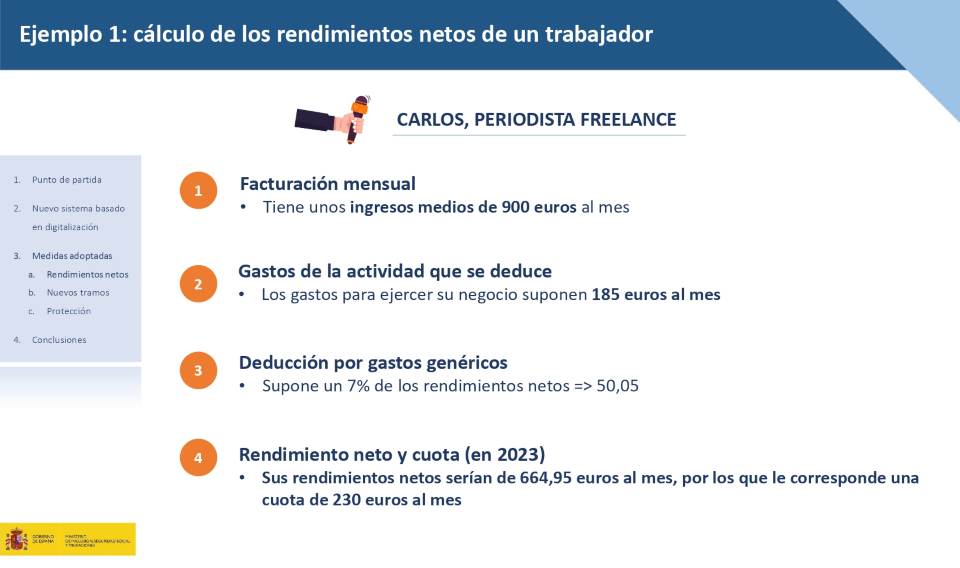

One of the first exercises that the self-employed will have to do when the new system is implemented next year will be to quantify the net income that they expect to obtain throughout the year. In other words, they will have to make an approximation of what their earnings will be between January 1 and December 31, 2023.

The Social Security has established a formula to determine this amount. This would be as follows: first calculate the annual net income from the activity (income minus deductible expenses), then add all the contributions paid by the self-employed to the Social Security during the year and subtract 7% or 3%, depending on whether the person is an individual or a company. Once the figure is obtained, it is divided by 12. The result is the net monthly income for which the contribution must be paid. The tables for calculating the contribution for self-employed workers according to their monthly income brackets for the years 2023, 2024 and 2025 are as follows:

Year 2023

| Net income tranches € / mes |

Minimum base € / month |

Maximum base € / month |

Monthly fee | ||

| Reduced table | Tranche 1 | ≤ 670 | 751.63 | 849.66 | 230 euros |

| Tranche 2 | > 670 y ≤ 900 | 849.67 | 900 | 260 euros | |

| Tranche 3 | >900 y < 1,166.70 | 898.69 | 1,166.70 | 275 euros | |

| General table | Tranche 1 | ≥ 1,166.70 y ≤ 1,300 | 950.98 | 1,300 | 291 euros |

| Tranche 2 | > 1,300 y ≤ 1,500 | 960.78 | 1,500 | 294 euros | |

| Tranche 3 | > 1,500 y ≤ 1,700 | 960.78 | 1,700 | 294 euros | |

| Tranche 4 | > 1,700 y ≤ 1,850 | 1,013.07 | 1,850 | 310 euros | |

| Tranche 5 | > 1,850 y ≤ 2,030 | 1,029.41 | 2,030 | 315 euros | |

| Tranche 6 | > 2,030 y ≤ 2,330 | 1,045.75 | 2,330 | 320 euros | |

| Tranche 7 | > 2,330 y ≤ 2,760 | 1,078.43 | 2,760 | 330 euros | |

| Tranche 8 | > 2,760 y ≤ 3,190 | 1,143.79 | 3,190 | 350 euros | |

| Tranche 9 | > 3,190 y ≤ 3,620 | 1,209.15 | 3,620 | 370 euros | |

| Tranche 10 | > 3,620 y ≤ 4,050 | 1,274.51 | 4,050 | 390 euros | |

| Tranche 11 | > 4,050 y ≤ 6,000 | 1,372.55 | 4,139.40 | 420 euros | |

| Tranche 12 | > 6,000 | 1,633.99 | 4,139.40 | 500 euros | |

Year 2024

| Net income tranches € / month |

Minimum base € / month |

Maximum base € / month |

Monthly fee | ||

| Reduced table | Tranche 1 | ≤ 670 | 735.29 | 816.98 | 225 euros |

| Tranche 2 | > 670 y ≤ 900 | 816.99 | 900 | 250 euros | |

| Tranche 3 | >900 y < 1,166.70 | 872.55 | 1,166.70 | 267 euros | |

| General table | Tranche 1 | ≥ 1,166.70 y ≤ 1,300 | 950.98 | 1,300 | 291 euros |

| Tranche 2 | > 1,300 y ≤ 1,500 | 960.78 | 1,500 | 294 euros | |

| Tranche 3 | > 1,500 y ≤ 1,700 | 960.78 | 1,700 | 294 euros | |

| Tranche 4 | > 1,700 y ≤ 1,850 | 1,045.75 | 1,850 | 320 euros | |

| Tranche 5 | > 1,850 y ≤ 2,030 | 1,062.09 | 2,030 | 325 euros | |

| Tranche 6 | > 2,030 y ≤ 2,330 | 1,078.43 | 2,330 | 330 euros | |

| Tranche 7 | > 2,330 y ≤ 2,760 | 1,111.11 | 2,760 | 340 euros | |

| Tranche 8 | > 2,760 y ≤ 3,190 | 1,176.47 | 3,190 | 360 euros | |

| Tranche 9 | > 3,190 y ≤ 3,620 | 1,241.83 | 3,620 | 380 euros | |

| Tranche 10 | > 3,620 y ≤ 4,050 | 1,307.19 | 4,050 | 400 euros | |

| Tranche 11 | > 4,050 y ≤ 6,000 | 1,454.25 | 4,139.40 | 445 euros | |

| Tranche 12 | > 6,000 | 1,732.03 | 4,139.40 | 530 euros | |

Year 2025

| Net income tranches € / month |

Minimum base € / month |

Maximum base € / month |

Monthly fee | ||

| Reduced table | Tranche 1 | ≤ 670 | 653.59 | 718.94 | 200 euros |

| Tranche 2 | > 670 y ≤ 900 | 718.95 | 900 | 220 euros | |

| Tranche 3 | >900 y < 1,166.70 | 849.67 | 1,166.70 | 260 euros | |

| General table | Tranche 1 | ≥ 1,166.70 y ≤ 1,300 | 950.98 | 1,300 | 290 euros |

| Tranche 2 | > 1,300 y ≤ 1,500 | 960.78 | 1,500 | 294 euros | |

| Tranche 3 | > 1,500 y ≤ 1,700 | 960.78 | 1,700 | 294 euros | |

| Tranche 4 | > 1,700 y ≤ 1,850 | 1,143.79 | 1,850 | 350 euros | |

| Tranche 5 | > 1,850 y ≤ 2,030 | 1,209.15 | 2,030 | 370 euros | |

| Tranche 6 | > 2,030 y ≤ 2,330 | 1,274.51 | 2,330 | 390 euros | |

| Tranche 7 | > 2,330 y ≤ 2,760 | 1,356.21 | 2,760 | 415 euros | |

| Tranche 8 | > 2,760 y ≤ 3,190 | 1,437.91 | 3,190 | 440 euros | |

| Tranche 9 | > 3,190 y ≤ 3,620 | 1,519.61 | 3,620 | 465 euros | |

| Tranche 10 | > 3,620 y ≤ 4,050 | 1,601.31 | 4,050 | 490 euros | |

| Tranche 11 | > 4,050 y ≤ 6,000 | 1,732.03 | 4,139.40 | 530 euros | |

| Tranche 12 | > 6,000 | 1,928.10 | 4,139.40 | 590 euros | |

Here are 2 hypothetical examples of how the calculation of monthly income should be done:

Example of a journalist

Example of a store

2.- Exception for the self-employed who have always paid more contributions

In spite of this, the self-employed who have been contributing for higher bases than their income will enjoy an exception: if the self-employed were contributing for a higher base than they should before 2022, they will be able to continue to do so once the new system comes into force. In this way, they will be able to maintain all the rights acquired after the entry into force of the reform.

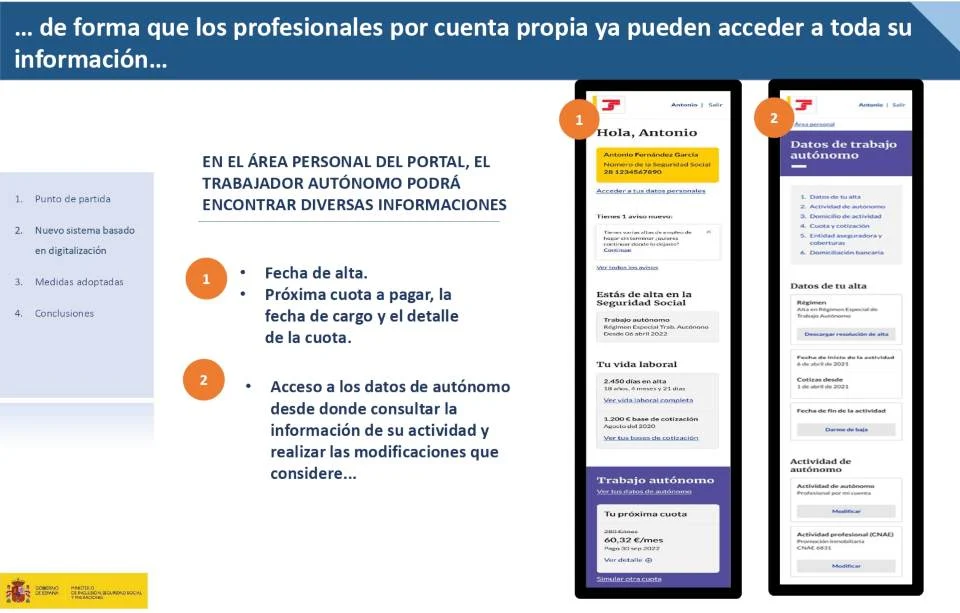

3.- What is the ImportaSS portal?

The ImportaSS portal is a tool developed by the Spanish Ministry of Inclusion, Social Security and Migration, so that the self-employed can carry out all kinds of procedures.

Currently, more than 40 different procedures can be carried out, such as requesting registration in the RETA, checking the next installment to be paid, consulting and paying debts, among others.

From January 1, 2023, this portal will also be the place to carry out all this exchange of information on the new contribution system for the self-employed.

Although all the details are not yet known, as announced by the Ministry, the management will be simple, with the self-employed being able to repeat the figure of net income from the previous year or make an estimate of their profits if they have more information.

Depending on the figure provided, the professional will be in one of the 15 net income brackets agreed until 2025 and a quota to be paid will be applied.

4.- Communication of the actual income forecast

The communication of the actual income forecast, better known as net income, will be made through the aforementioned Social Security portal ImportaSS. The self-employed must enter their income and, automatically, the Social Security will inform them of the contribution base that corresponds to them and the contribution that they must pay, depending on the bracket where they are located according to the income reported.

Self-employed workers who have been paying contributions on higher bases previously, can choose between the minimum contribution offered by the new system according to their bracket or the maximum contribution included in the new system.

5.- ImportaSS will let you know what your contribution is and when you will be charged

Once the income forecast has been confirmed and, therefore, the net income bracket and the quota, ImportaSS will be able to inform the self-employed worker about the day on which the Social Security will proceed to pay the quota. In other words, this tool will inform the self-employed about the amount of the contribution and the day on which the payment will be made, as shown in this screenshot.

The ImportaSS portal

6.- Possibility of changing bracket every two months

With the new contribution system, self-employed workers will be able to change their net income bracket every two months. This can be done through the ImportaSS tool, as long as it is done during the following dates:

– 1 March, if the application is made between 1 January and 28/29 February.

– 1 May, if the application is made between 1 March and 30 April.

– 1 July, if the application is made between 1 May and 30 June.

– 1 September, if the application is made between 1 July and 31 August.

– 1 November, if the application is made between 1 September and 31 October.

– 1 January of the following year, if the application is made between 1 November and 31 December.

This new feature will allow them to adapt the operation of their business more closely to the payment of their contributions.

7.- Compulsory filing of income tax returns

With the new system of contributions based on real income, all self-employed workers will be obliged to file an income tax return.

The presentation of the RENTA will be compulsory because it will be used to cross-check the data from the Tax Agency and the Social Security, and to check what the self-employed person’s net income has really been.

8.- Regularisation of the information submitted by the self-employed person

Once the self-employed submit their personal income tax return with the RENTA in 2024, the Social Security will proceed to check whether or not the self-employed person has complied with the income forecast made at the beginning of the year. Two situations may arise here:

– That the self-employed have paid more contribution than they should have. This is called overpayment, in which case the Social Security will refund the excess.

– The self-employed have paid less contribution than they should have. This is called underpayment and the self-employed will have to pay the Social Security.

9.- Resolution of the regularisation

With the contributions of the self-employed, the same thing will happen as with the RETA. Once the year has elapsed and the regularisation has been completed, they will either have to pay the Administration or receive a refund. However, certain deadlines have been established in the regulatory text. According to the agreed document, the self-employed have two months to return to the Social Security the unpaid contributions that correspond to them according to their net income. And the Administration has four months to return to the self-employed the overpayments made during the year.

Solve your doubts

✅ Our staff speaks perfectly Spanish, Valencian, English and German with what will be able to communicate with us in your own language and thus clearly resolve your queries.

📍 Denia – Plaza del Convento, 6 – Mezzanine floor door B

📍 Valencia – Calle Creu Roja, 1 – Block 6, Floor 1, door 10 (* only by appointment)

✉📞 Contact: info@firmalex.com – Tel. +34 966 421 416 – Whatsapp +34 622 497 615